Your Money, Organized: How to Fund Today, Protect Tomorrow, Grow Wealth

Understand how to structure your finances into Liquidity, Stability, and Growth buckets

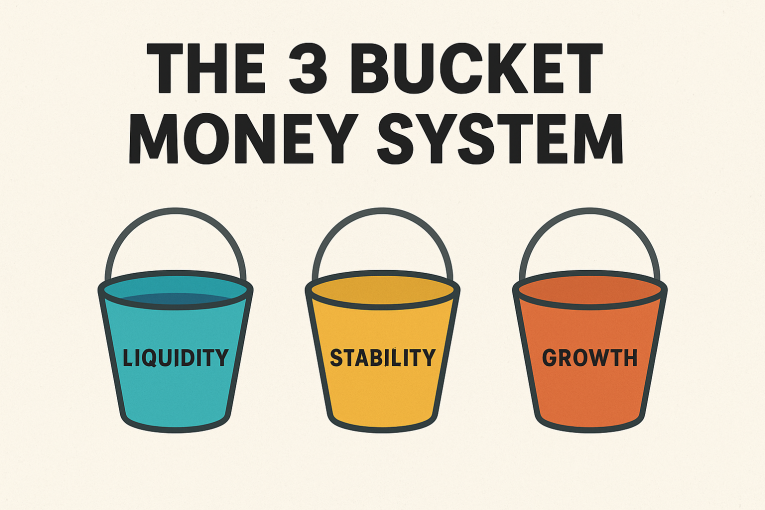

If money feels “fine” most months but stressful when anything unexpected happens, the fix usually isn’t a new budget app—it’s a better structure. One of the cleanest frameworks is the three-bucket system:

-

Liquidity (cash you can access immediately)

-

Stability (low-volatility money for the next few years)

-

Growth (long-term investing for wealth building)

Think of it like building a house: liquidity is your smoke alarms and fire extinguisher, stability is your foundation, and growth is the extra stories you add over time.

Bucket 1: Liquidity (your “don’t panic” money)

Liquidity is money you can use today without selling investments or taking on debt. This is where your emergency fund lives—cash set aside for unplanned expenses like car repairs, medical bills, or a temporary loss of income. Consumer Financial Protection Bureau

What it’s for

-

True emergencies and financial shocks

-

Preventing credit card debt

-

Avoiding raiding retirement accounts when life happens

How much should be in Liquidity?

Rules of thumb vary, but commonly you’ll hear 3–6 months of essential expenses (housing, utilities, food, insurance, minimum debt payments) for many households. Vanguard+1

Vanguard also notes that emergency savings targets can differ by situation (income stability, insurance deductibles, dependents), and provides goal-setting approaches for “spending shocks” and “income shocks.” Vanguard

Where to keep it

-

High-yield savings account (HYSA)

-

Money market deposit account (depending on rates/terms)

-

A checking “buffer” for near-term bills (optional)

The goal isn’t maximum return—it’s maximum reliability.

Bucket 2: Stability (your “planned future” money)

Stability is money you may need in the next 1–5 years—where you want some return but you can’t afford big swings. This bucket reduces the chance you’ll be forced to sell Growth investments at a bad time.

What it’s for

-

Known upcoming goals: property taxes, insurance premiums, planned home repairs

-

Big purchases in a few years: vehicle replacement, down payment, tuition

-

Bridging funds if income is variable or cyclical

How much should be in Stability?

Start by listing goals that are:

-

Too big for monthly cash flow

-

Too soon for stock-heavy investing

A simple method:

-

Add up expected 12–36 month “known” costs (conservatively).

-

Add a “life happens” cushion if your job/industry is volatile.

Where to keep it (examples)

-

High-yield savings or money market (for 0–12 months)

-

Short-term Treasury bills or Treasury ETFs (for some people)

-

Short-duration bond funds can be used, but remember: bonds can still fluctuate

The Stability bucket is about reducing regret—you’re choosing calmer performance so you can confidently fund near-term plans.

Bucket 3: Growth (your “future wealth” engine)

Growth is money invested for 5+ year goals—retirement, long-term wealth, and freedom. It’s designed to ride through volatility, because time is what makes this bucket work.

What it’s for

-

Retirement investing (401(k), IRA)

-

Wealth building (brokerage account)

-

Long-term goals: financial independence, legacy giving, future real estate plans

How much should be in Growth?

As much as possible after Liquidity and Stability are handled—because the real power of Growth is consistency over time.

Where to put Growth funds

-

Diversified stock index funds / ETFs (often used for long horizons)

-

A stock/bond mix based on risk tolerance and time horizon

-

Tax-advantaged accounts first, when available

The key is to treat Growth like a fruit tree: don’t dig it up every time the weather changes.

How to set up the system (simple, practical steps)

Step 1: Define “essential monthly expenses”

Calculate your essentials (not lifestyle): housing, utilities, groceries, insurance, minimum debt payments, transportation. This becomes the basis for your Liquidity target. Vanguard

Step 2: Fund Liquidity first (even if it’s small)

If you’re starting from zero, your first milestone might be $1,000 to $2,000 while you stabilize cash flow, then build toward multiple months of essentials. (Vanguard discusses starter targets and tailoring your goal to your situation.) Own Your Future+1

Step 3: Build Stability around real dates

Put due dates on goals:

-

“New roof within 36 months”

-

“Replace vehicle in 24 months”

-

“Property tax bill every December”

Stability becomes your “scheduled adulting” account.

Step 4: Automate Growth so it’s boring

The best Growth plan is the one that runs when you’re busy, stressed, traveling, or distracted.

-

Auto-contribute each paycheck

-

Auto-invest monthly from checking

-

Rebalance on a schedule (not on feelings)

Step 5: Use rules for moving money between buckets

A clean rule set:

-

Once Liquidity hits target, extra savings can flow to Stability/Growth.

-

If an emergency hits, spend Liquidity first; then rebuild it before adding more to Growth.

-

Revisit targets when life changes (baby, job change, moving, health events).

Common mistakes (and how to avoid them)

-

Investing Growth money before Liquidity exists → leads to panic-selling later.

-

Calling “wants” an emergency → define emergency rules in writing.

-

Overstuffing Liquidity forever → once you’ve hit a sensible emergency target, let more money work in Growth.

-

Ignoring intent → bucket systems work best when each bucket has a clear job. (J.P. Morgan describes organizing money by “buckets” to align dollars with intent.) J.P. Morgan Private Bank

The payoff: less stress, better decisions

The three buckets don’t just organize dollars—they organize behavior. Liquidity helps you sleep. Stability helps you plan. Growth helps you build wealth. And when markets wobble or life throws curveballs, you’re far less likely to make a costly, emotional financial decision.